New Base for Contribution calculation

In accordance with the amendments to the Pension and Disability Insurance Act, we would like to inform you about a change that also affects student work.

Starting from February 1, 2024, the calculation of duties and contributions for student work will be calculated on two different bases:

✅ CONCESSION FEES: the basis for calculation are the gross earnings of the student.

✅ CONTRIBUTIONS: the basis for calculation are the gross earnings, reduced by 10 % for standard costs.

✅ The change also affects net earnings of pupils/students, as the base (gross earnings) for the calculation of the contribution to the pension and invalidity insurance (PIZ) is also reduced by 10 %. The PIZ contribution of a pupil/student is now 13.95 % of the gross base (previously 15.5 %)

✅ Changes apply to the invoice date, not the work date. They are included in invoices issued after February 1, 2024.

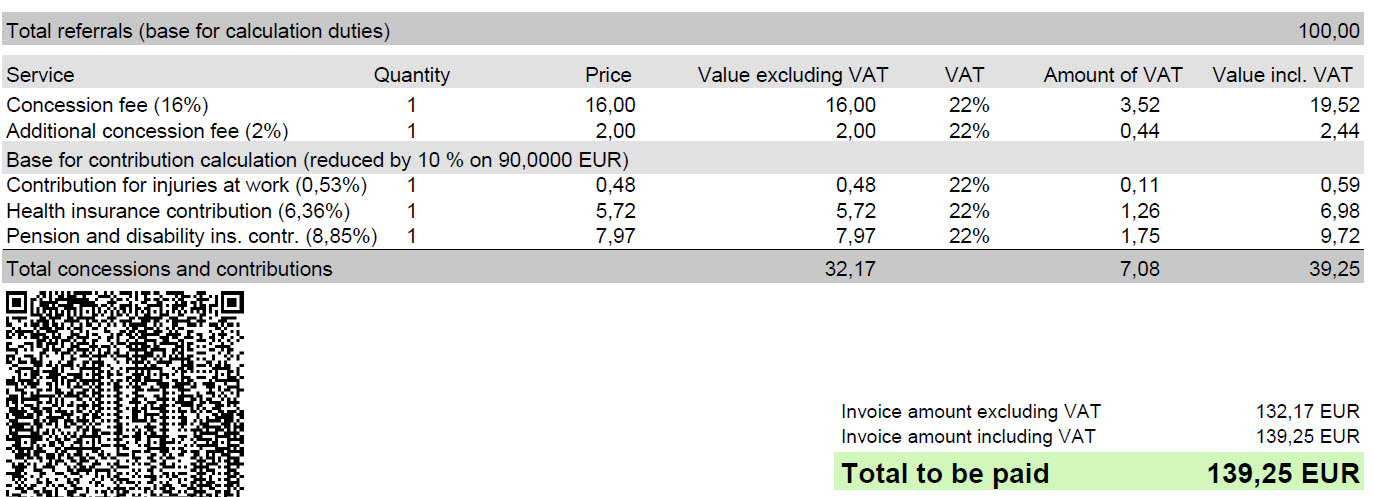

Invoice Example when concession fees are calculated from "Total referrals" based on gross earnings, and contributions are from 10% reduced gross earnings:

- Base for calculation duties: 100 €

- Basis for contributions calculation, 10 % lower than 100 €: 90 €

▶ The percentages on the invoice remain the same, as only the basis (reduced by 10 %) has changed.

Calculation Example when both duties and contributions are based on gross earnings:

- 16 %– concession fee (unchanged)

- 2 % – additional concession fee (unchanged)

- 14.17 %– social security contributions (previously 15.74%, now reduced by 10%)

✅ CALCULATION: 16 % + 2 % + 14.17 % = 32.17 % (previously 33.74 %)

✅ The total percentage of duties and contributions from February 1, 2024, is 32.17 %, plus 22 % VAT.

➡️ Click on the calculator to calculate the amount on the invoice.