The long-term care contribution also for student work

Objavljeno: 20. 8. 2025

We would like to inform you about a new legal obligation that also affects the calculation of student work

As of 1 July 2025, the long-term care contribution is calculated in accordance with the Long-Term Care Act (ZDOsk-1).

➡️What does this mean?

▶ For work performed from 1 July 2025 onwards, the invoice for student work also includes the long-term care contribution at a rate of 1 %.

▶ The contribution is paid by the employer, which means the student’s/pupil’s gross and net earnings remain unchanged.

▶ The basis for calculating the long-term care contribution is the gross amount of the student/pupil, reduced by 10% of standardized expenses.

▶ No additional action is required on your part – the long-term care contribution will be automatically included on the invoice for student work.

➡️ Who does this obligation apply to?

From 1 July 2025, the contribution is calculated for all students and pupils aged 18 or over who are citizens of the Republic of Slovenia or foreign nationals with compulsory health insurance coverage.

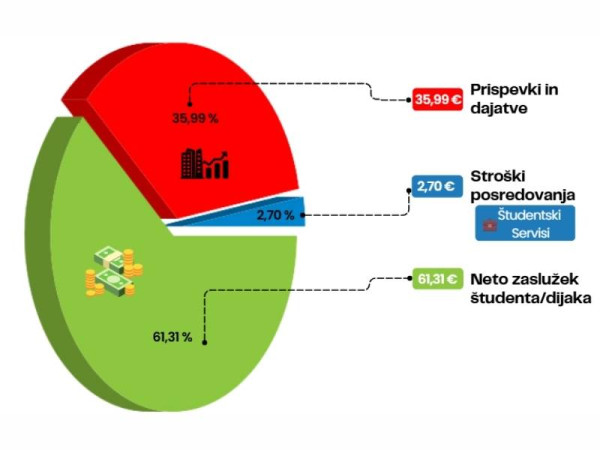

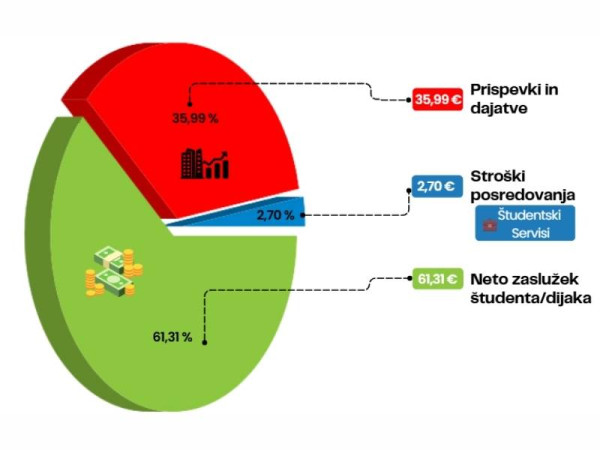

📌 Example of calculation:

💰 Student gross pay = 10 €

➡️ Basis for LTC = 10 € – 1 € (10 %) = 9 €

➡️ LTC contribution = 1 % of 9 € = 0.09 € (employer’s cost)

For more information, we are available to assist you.

Pripravil: e-Študentski Servis

Novice za poslovne partnerje