Basic information for international students

Fill the form and become a member of the e-Student Service

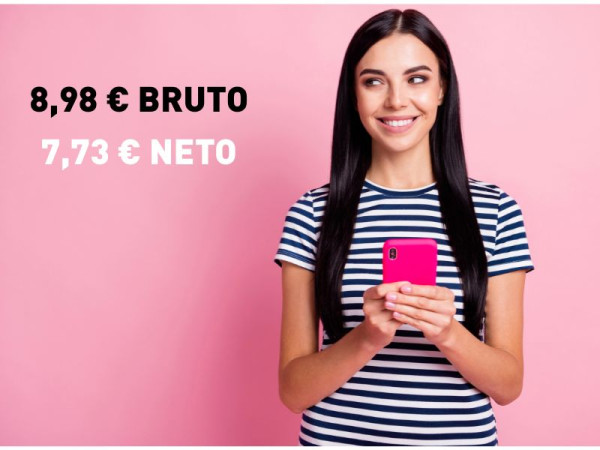

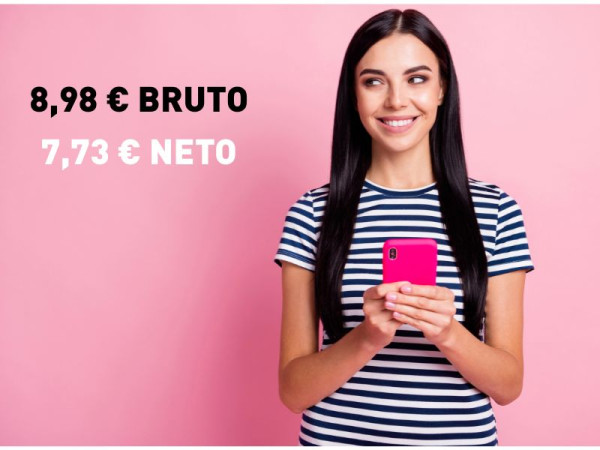

The legal minimum hourly rate for student work from February 5, 2026 is:

-

GROSS: 8.98 €

-

NET: 7.73 € (paid to student bank account)

The difference between gross and net is a 13.95 % pension contribution, which is paid to the state and counts towards your pension period.

-

Payment per piece or task must meet the minimum hourly rate.

To convert gross earnings to net and vice versa, use our calculator.

Employers usually set the hourly rate in advance, which is often mentioned in the job ad. To avoid misunderstandings, it’s wise to confirm the rate with the employer.

If you find a job independently, you and the employer must agree on the hourly rate. Training for the job is also paid. The rate must not be lower than the legal minimum.

If the employer offers a lower rate than advertised or below the legal minimum, notify us.

It means you receive the payment the same or next working day after we receive the timesheet, while the employer settles the invoice within the agreed payment term.

If earnings are not advanced, you receive the payment when the employer pays the invoice.

If payment is delayed, we contact the employer to ensure you receive it as soon as possible.

-

e-Študentski Servis pays the entire earnings upfront as soon as they receive the timesheet from the employer (for employers with good credit).

-

This means you receive 100 % of your payment immediately without waiting for the employer to process their payment.

-

e-Študentski Servis advances 95 % of student earnings.

The payment is processed once the employer submits the hours to e-Študentski Servis.

It’s important to agree on a payment date before starting the job, which is usually between the 1st and 15th of the month for the previous month’s work, but it can be later.

Typically, employers send the timesheet once a month, but you can arrange a different schedule with the employer.

Notification on your phone: On the day your payment is transferred to your bank account, you will receive a notification on your phone. The notification usually arrives around 3:00 PM, and the money is deposited into your account around 4:00 PM.

ONLINE: You can also check your earnings in your online profile.

KIDO 12 is a form that non-residents of Slovenia use to request a refund of the income tax advance (22.5 %). You get back the advance on the income tax if you come from a country that has signed a double taxation agreement with Slovenia.

Make a quick calcultation to check if your country has such an agreement.

After you receive a payment for student work to your bank account, we can send you fullfiled KIDO 12 form by e-mail, just let us know that you need it.

To get your income tax back you need:

- KIDO Form 12 and specification of amounts.

- Certificate of education.

- Proof of residency in your country of origin.

- If you are over 26 years old, attach a certificate of first enrollment in studies.

You can send all three forms to the Financial Administration of the Republic of Slovenia (FURS) or use the eTaxes app.

▶️ Instructions for using eTaxes and registration.

📣 Using the app will help you complete your application faster.

If you are a non-resident and planning a long-term stay in Slovenia, you can regularise your residency status. More information.

NON-RESIDENTS of Slovenia have the following deductions from each payment:

- 13,95 % pension contribution, which is transferred to the state and counts toward the pension period

- 22,5 % income tax advance.

Example calculation for a NON-RESIDENT:

-

20 hours at 10 €/hour gross (6.70 €/hour net for non-residents)

-

You receive 134.07 € net

-

Counts towards your pension insurance: 27.90 €

-

Tax prepayment: 38.02 €

If Slovenia has a double taxation agreement with your country, you can get a refund of the tax advance.

We have prepared a calculator where you can calculate your payment. When calculating, it is important to select the country you are coming from.

To get your income tax back you need:

- KIDO Form 12 and specification of amounts.

- Certificate of education.

- Proof of residency in your country of origin.

- If you are over 26 years old, attach a certificate of first enrollment in studies.

You can send all three forms to the Financial Administration of the Republic of Slovenia (FURS) or use the eTaxes app.

▶️ Instructions for using eTaxes and registration.

📣 Using the app will help you complete your application faster.

▶️ Once approved, FURS will return the tax advance to your bank account, usually within one month, up to the amount of the special personal allowance for that calendar year.

If you are a non-resident and planning a long-term stay in Slovenia, you can regularise your residency status. More information.

If you are a RESIDENT of the Republic of Slovenia, you receive the net earnings to your bank account.

The difference between gross and net is a 13.95 % contribution for the pension, which is paid to the state and counts toward your pension period.

Example calculation for a RESIDENT:

-

Work 20 hours at 10 €/hour gross (8.61 €/hour net)

-

You receive: 172,10 € net.

-

Counts towards your pension insurance: 27.90 €

-

Use our calculator to determine gross or net hourly rates.

An employer cannot lower your hourly wage for work that has already been completed or change any previously acquired rights retroactively.

The hourly rate can only be reduced or adjusted from the moment the employer notifies you of the change.

Yes, the employer can transfer earnings retroactively, as you completed the work while you still had a valid student status and referral.

You can generate a report of your hours in the Earnings menu.

- First, select the year.

- Then, click the PRINT EARNINGS button at the bottom.

- The document will show the hours worked and the total number of hours.

Kako podaljšam status?

Piši nam na [email protected] ali pokliči na najbližjo poslovalnico.

Obvestila za dijake in študente