Basic information for foreign companies

The legally determined minimum hourly rate for student work as of February 5, 2026 is:

✅ *GROSS: 8.98 €

✅ *NET: 7.73 €(the amount transferred to the student’s bank account)

➡The difference between gross and net means that a contribution for pension and disability insurance (PIZ) of 13.95 % is deducted from the payment and counted toward the pension period.

- Payment by agreement, per piece, per survey, etc., must be paid at least at the minimum hourly rate.

We have prepared for you:

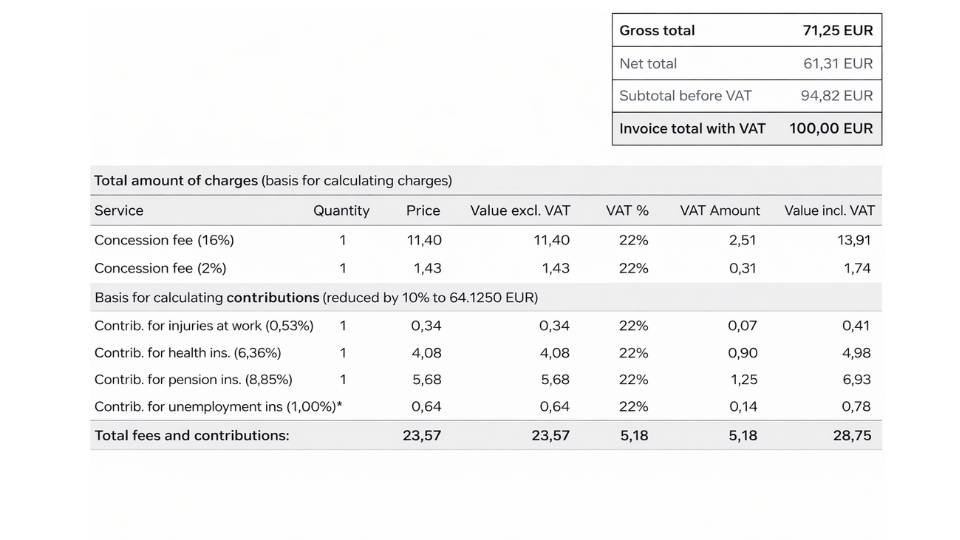

Example of an invoice, where concession charges are calculated from the gross earnings "Total amount of referrals," and contributions are calculated from the gross earnings reduced by 10 %:

- The pupil/student receives 61.31 € net (71.25 € gross).

- The employer pays 100 € (VAT included).

QUICK CALCULATION when charges and contributions are calculated from gross earnings:

- 16 % – concession charge (unchanged)

- 2 % – additional concession charge (unchanged)

- 15.07 % – social security contributions (reduced by 10 % from the base)

✅ CALCULATION: 16 % + 2 % + 15.07 % = 33.07 %

✅ The total percentage of charges and contributions as of February 1, 2024 is 33.07 %, with an additional 22 % VAT applied.

➡️ Click on the calculator for a quick calculation of the invoice amount.

The concession charge (2,70 %) is legally mandated, and all concessionaires (student services) have the same concession charge.

The total percentage of charges and contributions is 33.07 %, with an additional 22 % VAT applied. Click on the calculator to calculate costs.

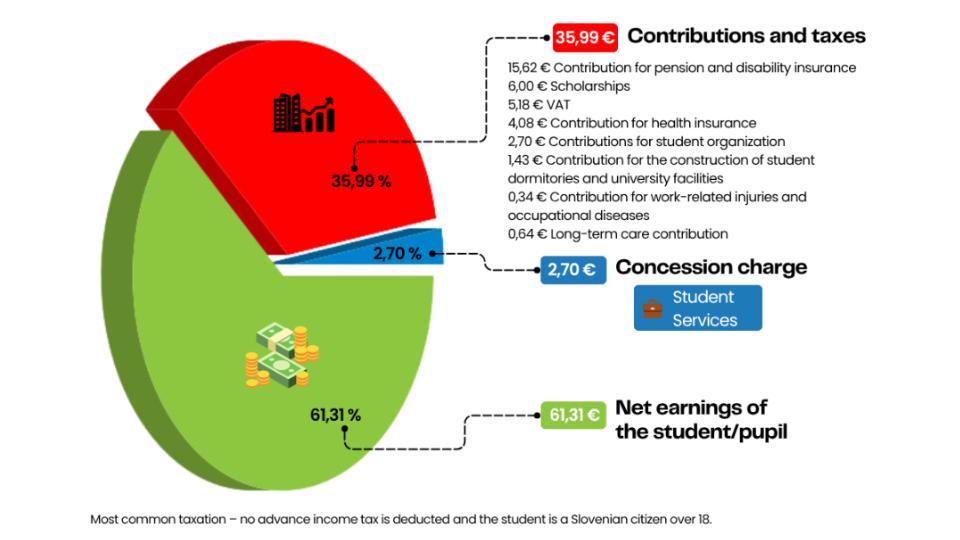

Distribution of student work costs

Calculation for the amount of €100 (VAT included, paid by the employer)

Advancing earnings means that for employers with good credit ratings, we transfer the money to the student immediately after the work is completed, once the employer submits the hours calculation and we issue the invoice.

The student receives the money on the same or the next business day, while the employer transfers the amount to e-Student Service upon receiving the invoice or by the agreed deadline stated on the invoice.

A student resident receives the net earnings into their bank account. The pension and disability insurance contribution (PIZ) of 13.95 % is deducted from the payment and counts toward the pension period.

Example calculation for a resident:

- The student works 20 hours at 10 €/hour gross (8.61 €/hour net)

- The employer pays 200 € x 1.3217 = 278,49 € (with VAT)

- The student receives 172,10 € net

We have prepared an easy-to-use calculator where you can calculate the gross and net hourly rate and the total amount on the invoice.

For non-residents, the following is deducted from each payment:

- 22.5 % income tax prepayment, and

- 13.95 % pension and disability insurance contribution. Until January 31, 2024, the PIZ contribution was 15.5 %, but from February 1, 2024, it has been reduced by 10 % to 13.95 %.

Example calculation for a non-resident:

-

The student works 20 hours at 10 €/hour gross (6.70 €/hour net for non-residents)

-

The employer pays 200 € x 1.3217 = 278,49 € (with VAT)

-

The non-resident student receives 134,07 € net

-

We have prepared a simple calculator where you can input the gross amount and calculate the net hourly rate for non-residents. When using the calculator, it’s important to select the country the non-resident is from.

-

Non-residents of Slovenia are liable for income tax on earnings sourced in Slovenia. If the Republic of Slovenia has signed a double taxation agreement with the student’s country, the non-resident may get the income tax prepayment refunded.

Individuals under 18, pregnant workers, and those on parental leave cannot work overtime and can work a maximum of 8 hours per day.

The Employment Relationships Act states:

-

Full-time work cannot exceed 40 hours per week.

-

Overtime work can last up to 8 hours per week, 20 hours per month, and 170 hours per year. A workday can last a maximum of 10 hours.

-

Due to the nature or organization of work, working hours can be irregularly distributed. In cases of irregular distribution or temporary redistribution of full-time work, the working hours cannot exceed 56 hours per week. The prohibition of working beyond full-time applies even in cases of irregular distribution or redistribution of working hours.

Yes, you can transfer earnings to a student retroactively, as the work was performed while they still had student status and a valid referral.

Payment for student overtime is not legally required.

To avoid misunderstandings, we recommend agreeing on the overtime pay with the student before the overtime work is performed.

Payment must be made at least at the minimum hourly rate.

-

You cannot reduce the hourly rate for work that has already been completed or change previously earned rights retroactively.

-

The hourly rate can only be reduced or changed going forward, after you have informed the student about the change.

-

The KIDO 12 form allows non-residents of Slovenia to request a refund of the 22.5 % income tax prepayment.

-

A refund can be requested by non-residents from countries with which Slovenia has signed a double taxation avoidance agreement.

-

With the help of a simple calculation, you can check if the student’s country has such an agreement by selecting the country and entering the amount.

-

The KIDO 12 form can be sent to the student after each payment, once a month, at the end of the year, or for the past 5 years.

-

The completed form should be submitted by the non-resident to the Financial administration of the Republic of Slovenia (FURS) or sent via the mobile app.

-

If FURS approves the refund, the withheld income tax prepayment will be transferred to the bank account within one month.

-

RECOMMENDATION: Non-residents planning to stay in Slovenia for an extended period are advised to apply for Slovenian resident status. More information.